BY N. PRASHANT CHOWDARY

04/1/2026

Only a fool. Not a wise man, is deluded by his own ideas; it is a fool who thinks that the imperishable is perishable, and gets deluded. Egotism is but an idea based on a false association of the self with the physical elements. When one alone exits in this as the infinite consciousness, how has what is called egotism arisen? In fact, this egotism does not exit any more than the mirage exists in the desert. Therefore, O Rama, abandon your imperfect vision which is not based on fact, rest in the perfect vision which is of the nature of bliss and which is based on truth.

VASISTHA’S YOGA

We are not made to view things as independent from each other. When viewing two events A and B, it is hard not to assume that A cause B, B cause A, or both cause each other. Our bias is immediately to establish a causal link.

NASSIM NICHOLAS TALEB

We can be blind to the obvious, and we are also blind to our blindness.

DANIEL KAHNEMAN

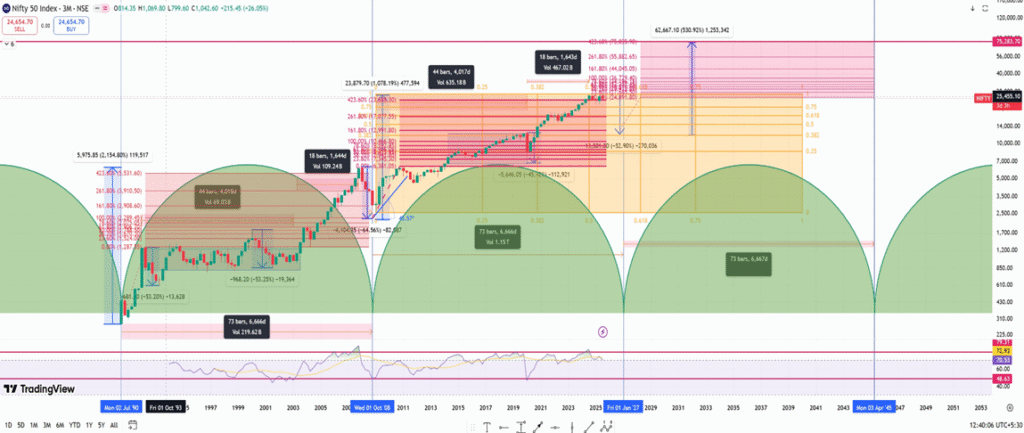

NIFTY 50 INDEX

Finding out why Nifty 50 has not moved much in the last year is the subject of this article. Hindsight analysis of Nifty 50 not moving much in the last one year is a dangerous task subject to many errors and bias, irrespective of constant flow of 3 lakh crores of sip money flowing in to the market and constant feeding of media narrative of Indian growth story. Pardon me on my ignorance if I am not able to establish the few factors for the non-movement of nifty. Main street has established many causes for this event like selling pressure by FII’S, trump traffic, war, rupee depreciation, no improvement in private capital spending etc. But we have missed the forest for the trees. I will try to list some of the main factors.

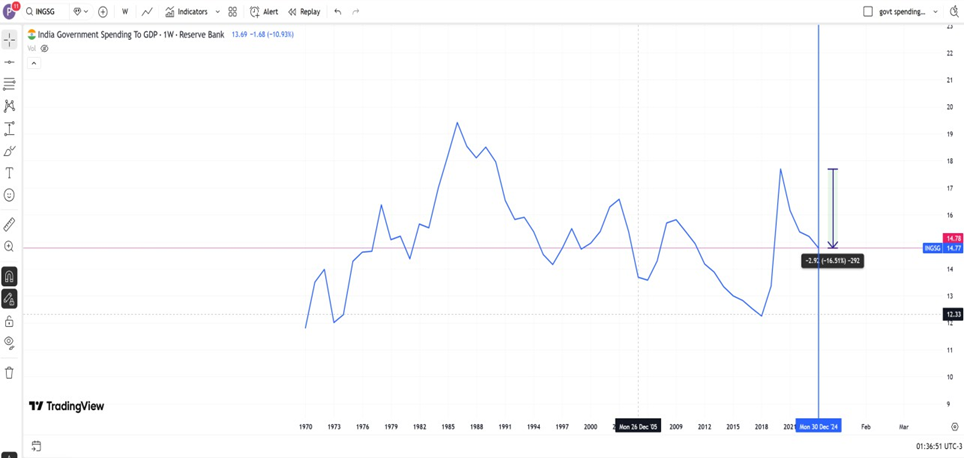

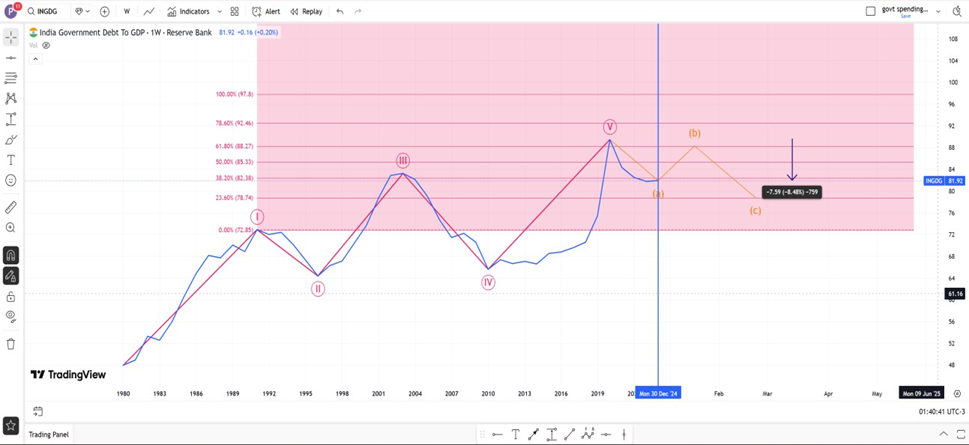

1. FISCAL CONSOLIDATION PATH:

In the present economic situation governments around the world are the major economic driver of growth by spending on infrastructure, India is not an exception. Every year national government spends approximately 11 lakh crores of its budget on infra push for growth and it decided to reduce its expenditure due to limitation of absorption capacity by government institutions for improvements in laying of roads and railways. In 2024 it has decided to reduce its fiscal deficit form 4.8% of the GDP to 4.4% of the GDP by 2027. As stock markets discount the future it has come to the conclusion that growth will not improve further than the trend line growth of 7% points in 2025 without improvement in government spending.

2. Monetary policy effect:

In 2024, the Reserve Bank of India (RBI) maintained a restrictive monetary policy stance for most of the year to control persistent food inflation. To specifically curb “unbridled growth” in riskier loan segments, the RBI enforced higher capital requirements for banks and NBFCs, effectively tightening the criteria for these loans. In December 2024 RBI withdraw 1.82 lakh of surplus money from the system and this led to a slower credit growth in 2025, which pulled the GDP down.

3. INFLATION:

India as a constant 6% inflation from the past two decades but 2025 it has experienced a deflationary scenario which has not added to the nominal growth rate. Indian inflation is majorly depended on the climate situation based on rain fall where 46 points of the cpi index is based on food inflation which is beautifully captured in fantastic fictional book “CHASING THE MONSOON” by Alexander frater then any economic data of the government. Japan stock market is a classic case of not rising in the past 20 years from a period 1990 to 2020 due to defamatory factors or lack of inflation. Due to this lack of inflation in the economy GDP growth as not improved beyond its trend line growth, which is not a welcome scenario for the stock market.

The anchor to the Nifty 50 index is the growth rate of the country, but due to liquidation effect in the economy and flow of outside money sometimes nifty moves higher where it has happed for the past 4 years in the bull run. In 2025 nominal growth rate is at 8% so nifty as consolidated at 26000 points having some volatility. I have a firm opinion that climate, women and markets cannot be predicted, only analyzed in hindsight. Hope 2026 governments and RBI changes its policy stands (seeing some sigh of this).

Happy new year.