BY N PRASHANT CHOWDARY

25/01/2026

Inflection points occur in the market, and around them performance can suffer, but you have to stick to your guns.

BY John Neff

You always need to be cognizant of six sigma events that can have ugly impacts on your portfolio and account for the approximate probabilities.

By Mohnish Pabrai

Unprecedented events occur with some regularity, so be prepared.

By Seth Klarman

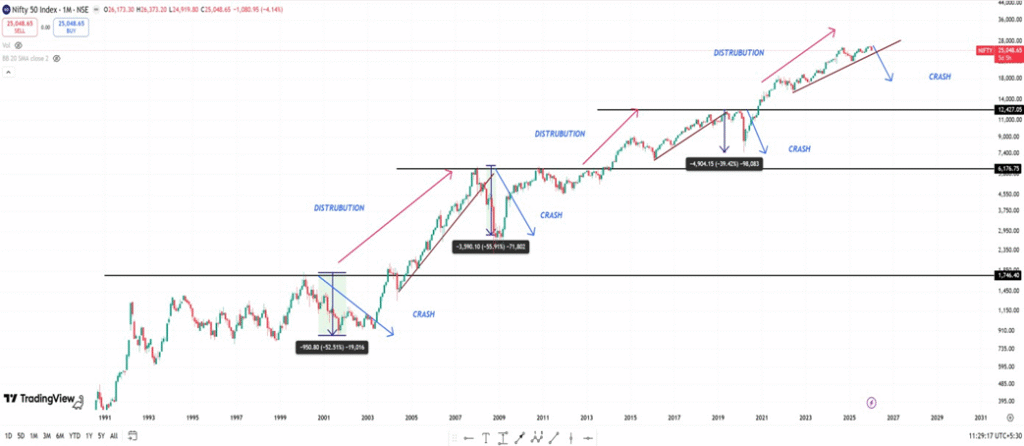

In stock market their will be Time correction and Price correction, Time correction has happened from November 2024 to December 2025 and there will be some butterfly effects in the stock market for price correction.

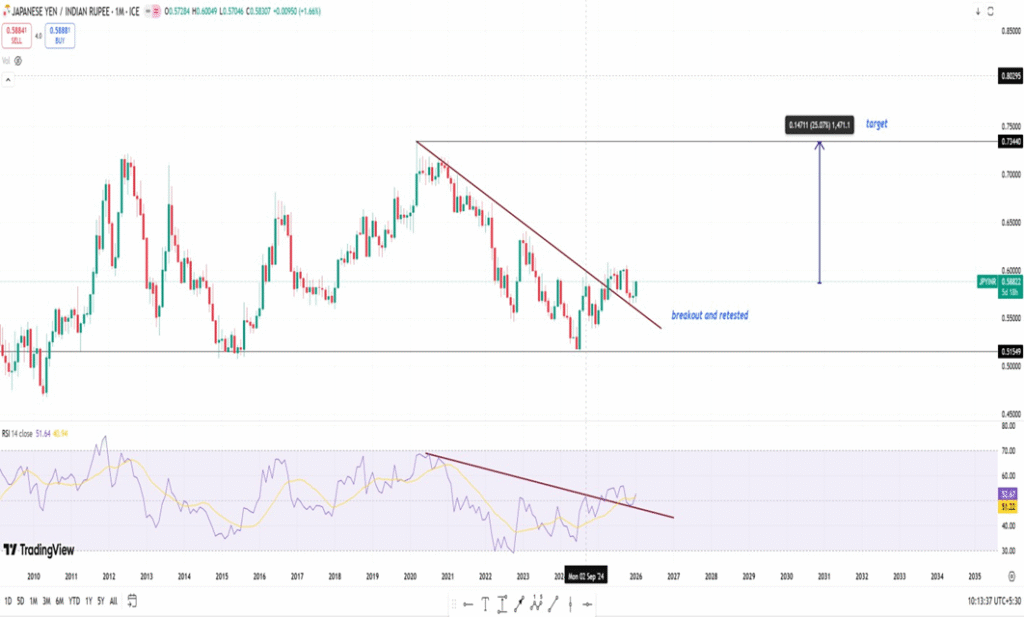

1.THE UNWIDENING OF YEN CARRY TRADE:

JPY ↑ → Carry Unwind → Global Leverage Break → FII Sell → INR Stress → Yields ↑ → Credit Tightens → Equity Collapse

2.DEPRECIATION OF THE RUPEE:

FII are selling now to buy at a later date because rupee is finding its own levels due to many factors.

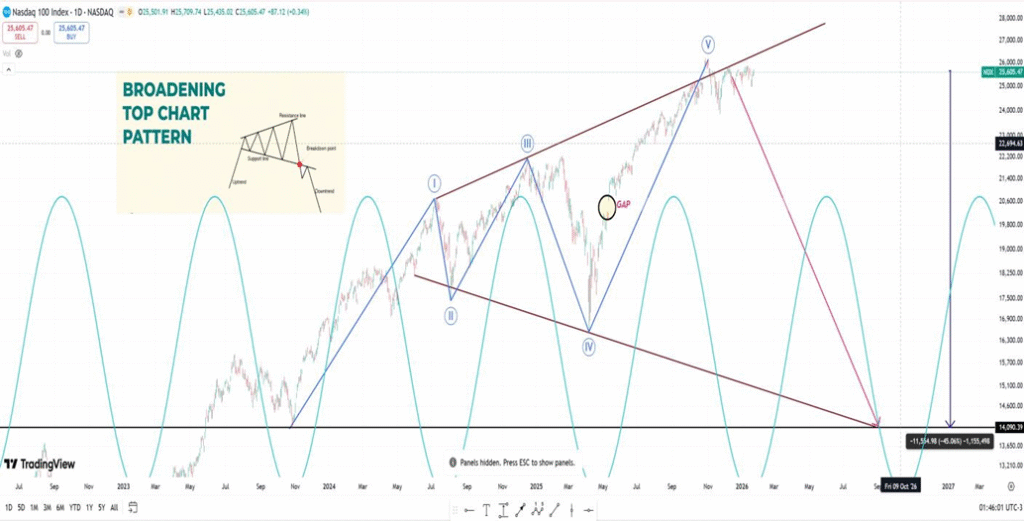

3.USA MARKET CORRECTION:

The correlation effect of Indian stock market is approximately 0.6 of the American stock market. When American markets fall, they will be a spillover effects in to the Indian market.

4.FLIGHT TO SAFETY:

US Government 10 years bond is believed to be the safest in the world. The yield of the bond is about to rise which will intensify FII selling in the Indian market.

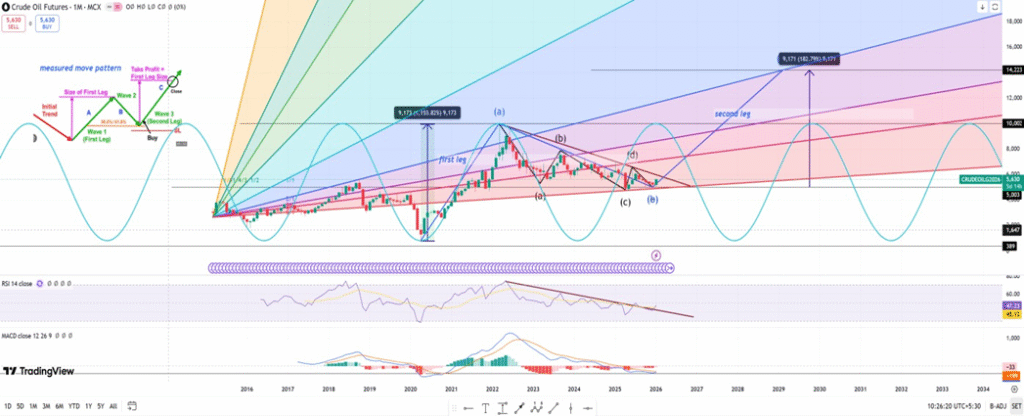

5.CRUDE OIL IMPACT:

India imports 85% of the crude oil and crude oil has formed a base and ready to fly which will put a pressure on current account deficit and it puts pressure on forward EPS of Nifty.

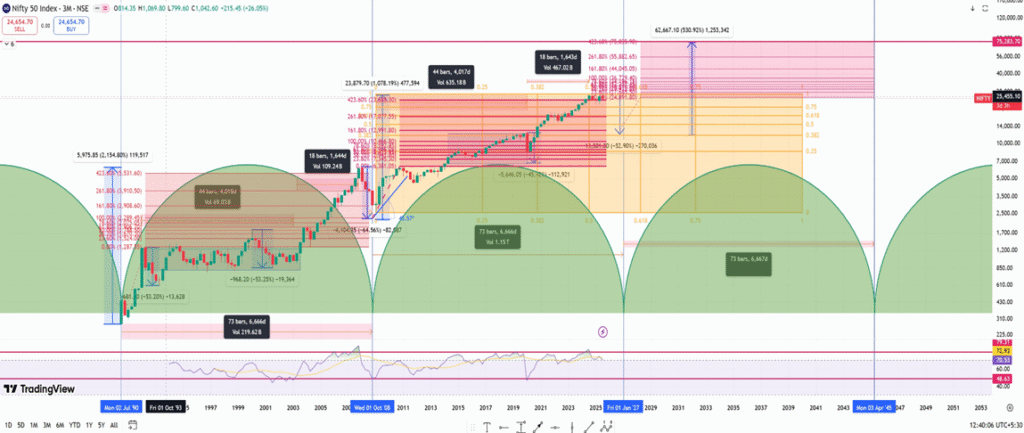

NIFTY 50 INDEX:

There is a quote in Tamil,

A bell sounds arrives even before an elephant arrives.

Similar warning signs are visible for Nifty. We should stay alert.

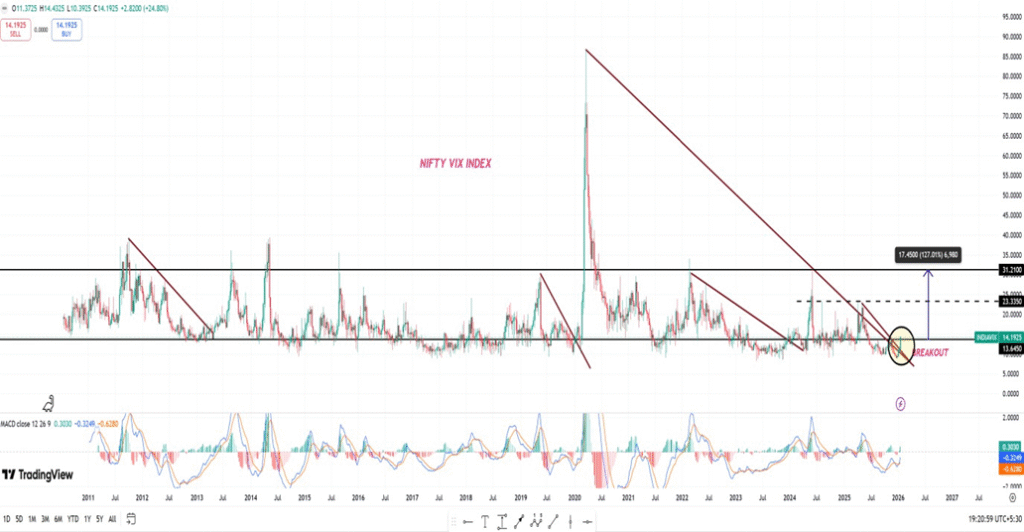

NIFTY VIX INDEX: