BY N PRASHANT CHOWDARY

03/02/2026

Lying, the telling of beautiful untrue things, is the proper aim of Art.

By Oscar Wilde.

The Party told you to reject the evidence of your eyes and ears. It was their final, most essential command. And if all others accepted the lie which the Party imposed, if all records told the same tale, then the lie passed into history and became truth.

By George Orwell.

As government claims If nominal GDP is growing at 7% and inflation is around 0.5%- and 10- year government bond yield are at 6.7%, it is a recipe for good performance of the economy. Foreign money should flood the market. In this situation rupee should appreciate, but why does rupee depreciate?

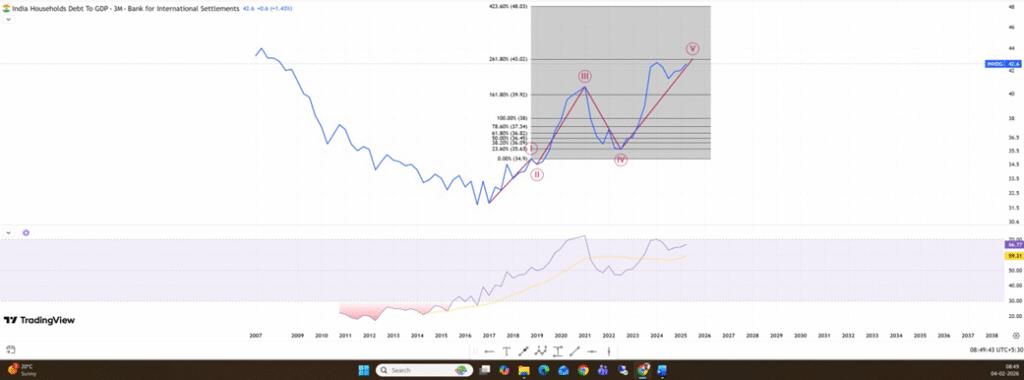

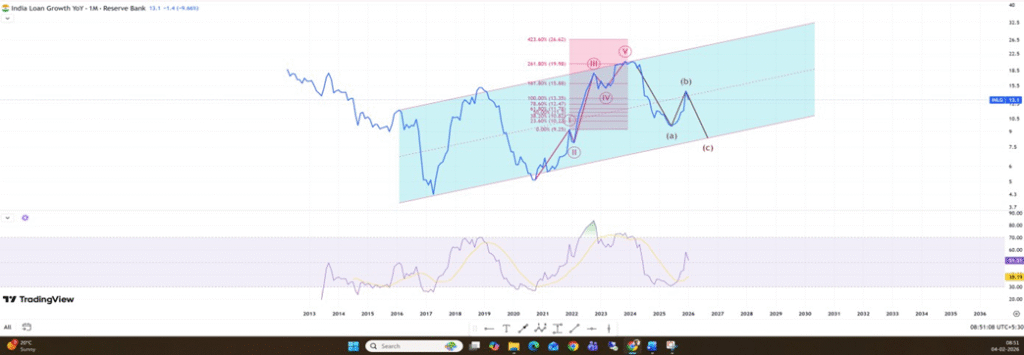

Governments around the world fabricate the data they publish. Indian economy is a consumption story where approximately 60% of the GDP comes from consumption. In the last two years consumption has remained flat and not growing as expected due to stretching of debt on household balance sheet, so the credit growth is falling. On the other side corporates are not willing to borrow because of the uncertainty and utilisation of the plant capacity is around 70% only and private capex has stayed at 12% of the GDP for the past 12 years and it is not improving irrespective of the many incentives by the government, unless corporations see growing demand they will not participate in credit growth. Government has identified the demand side problem and try to solved the issue by reducing the rates of GST and increasing the slab rate of income tax. Instead of that government should have tried to reduce the petrol rate by 10 to 20 rupees so that it might have left some money in the people’s pocket. People take fresh borrowing either to invest or spend. Unless people income increases or fresh borrowing happens, growth cannot revive or it takes some time to deleverage.

On the inflation front government has taken CPI data in to consideration which constitute 46% of food items where due to heavy rains country has a surplus production last year which helps in recording 0.5% of inflation. If we consider WPI data in to consideration (developed countries use WPI index for calculating inflation) which is at 4% then the real growth rate falls to 3% (7- 4), which is matching with consumption growth (sale growth of nifty 500 companies is at 5% in Q4 2025). May be Foreigners has discounted this factor in the forward earning per share comparing with the valuations of other countries to liquidate their positions, which is putting immense pressure on the rupee front. They will start accumulating only when they see trend reversing on growth front or valuations justify. In last two years FII are exiting the market (both debt and equities) which is putting pressure on rupee and RBI is currently facing the impossible trinity problem where rupee is a sacrificial lamb.

INDIA HOUSEHOLDS’ DEBT TO GDP:

INDIA LOAN GROWTH:

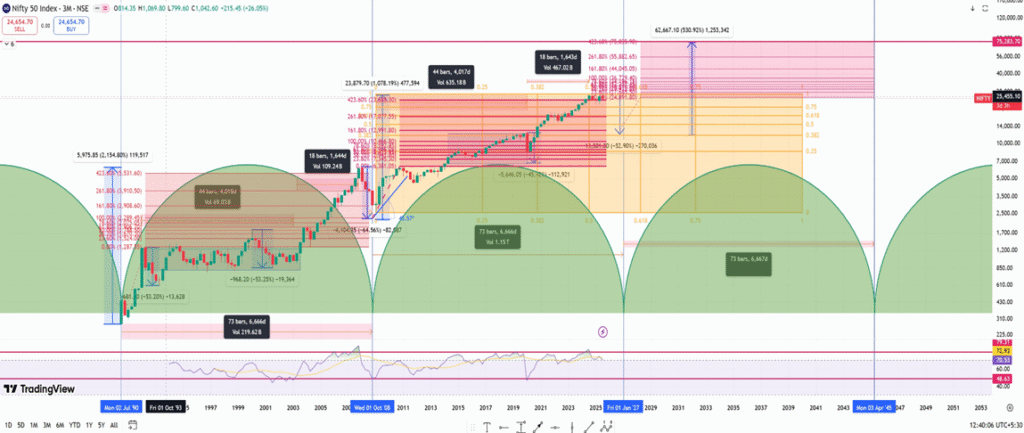

NIFTY INDIA CONSUMPTION INDEX:

HOPE IS NOT THE PLAN.

THANKS.