By N PRASHANT CHOWDARY

Markets are a complex organism where they are many factors which determine its direction. Today I try to list some of the main reasons for the coming fall of nifty. On a disclaimer note I am not predicting or imagining things to happen. As a student of J Krishnamuthi philosophy humans mind always operate on “what should be” rather then “what is”. For investing we need to think what will happen in the future, but the future is unknown. Rather than thinking of the future we need to carefully analyze the present (“what is”). Here are the factors which might cause for the fall of nifty.

1.18- years real estate cycle:

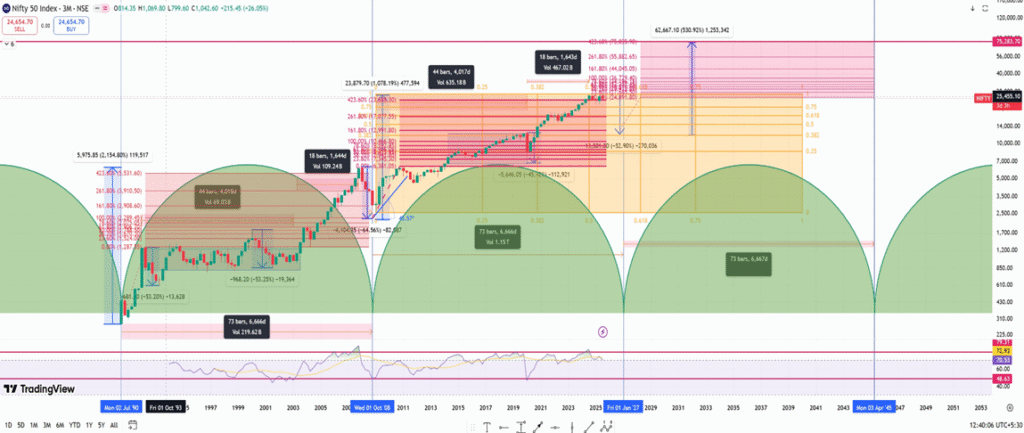

Stock market is the barometer of the business performance. In Indian economy 15 to 16 percentage of the GDP is real estate market, it follows cycles. It has a strange phenomenon of following 18 years cycle (1990-2008-2026), which has been identified by Austrian school of economics. Even developed countries like usa and Europe follow the same pattern. When real estate slows down every allied activities slows down and its effects the GDP.

Nifty Realty Index

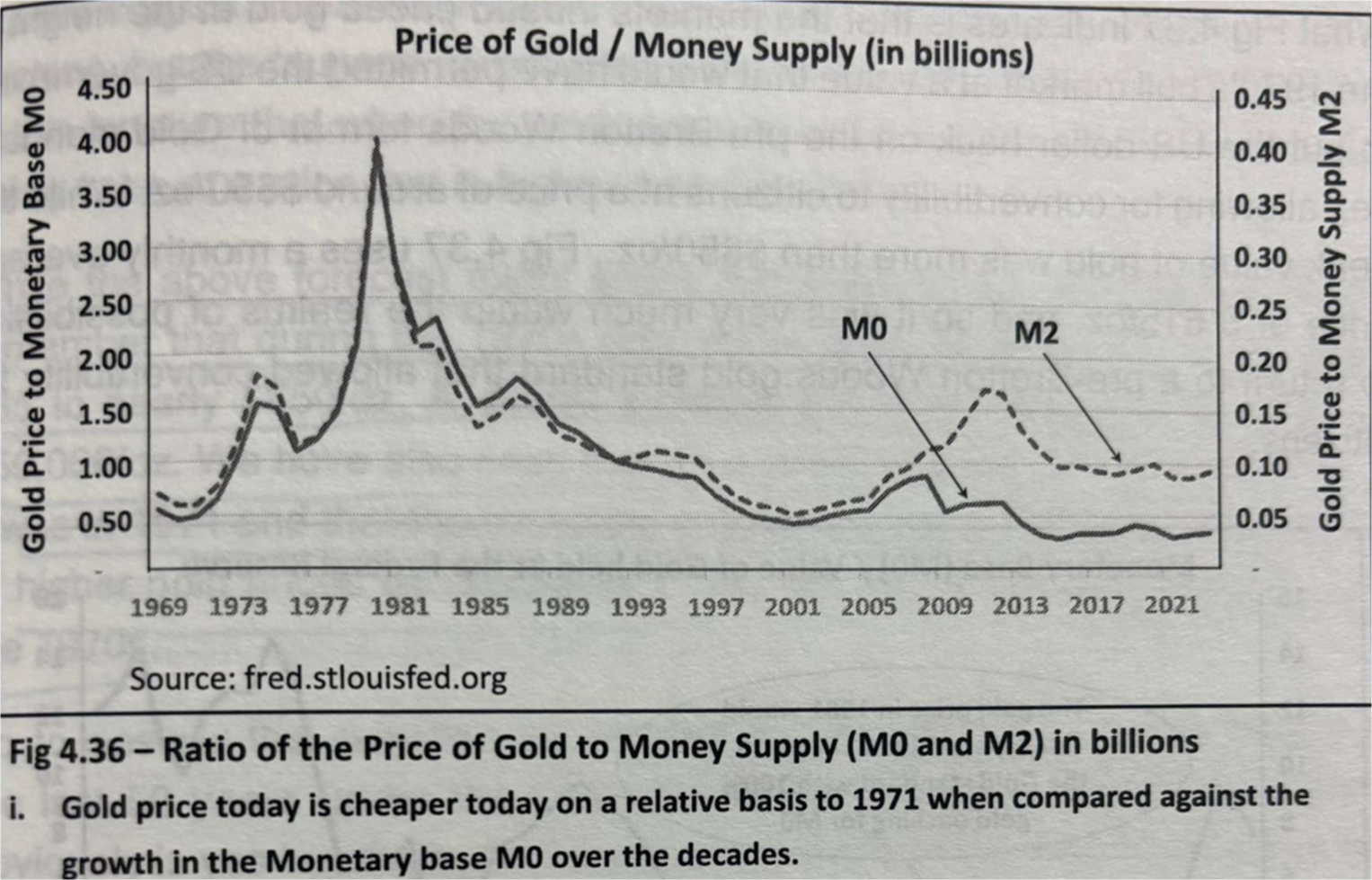

2.Flight to safety:

Now a days everyone are talking about de-dollarization and gold as a alternative currency, but dollar has its own strength. It can lose its value in the long run due to political and economic factors but in every crisis (1987-2000-2008-2022) money flows back to dollars increasing its value which puts pressure on other currency. Then foreign investors have a currency depreciation risk so they intensify their selling. From past data, a 10% DXY rise triggers ₹1.5–2.5 lakh crore in average FII selling.

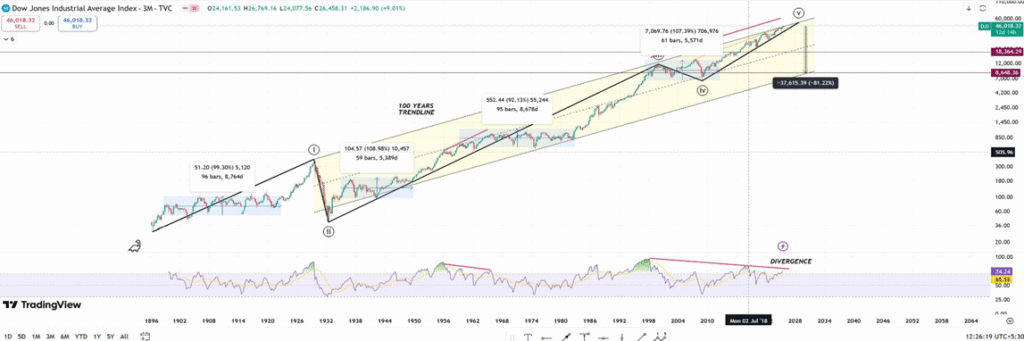

3.Global Market Correction:

United states stock market is in bubble territory, if any correction takes place then it will have a drawdown effect on Indian stock market. And from the past data it has a correlation of 0.86. Stock markets are like covid virus it has contagiousness effects where fear spreads like fire.

4.Growth slowdown:

In india, corporate profitability and equity valuations depend on both volume growth and price growth. Together they form nominal GDP. For over two decades, India’s nominal growth averaged around 12%, a level that allowed markets to sustain higher valuation multiples. In the current current cycle, nominal gdp growth has fallen to about 8%. The main thing with Indian economy is lack of demand not the supple problem, slowly the government is addressing this problem(reduction of gst rates).

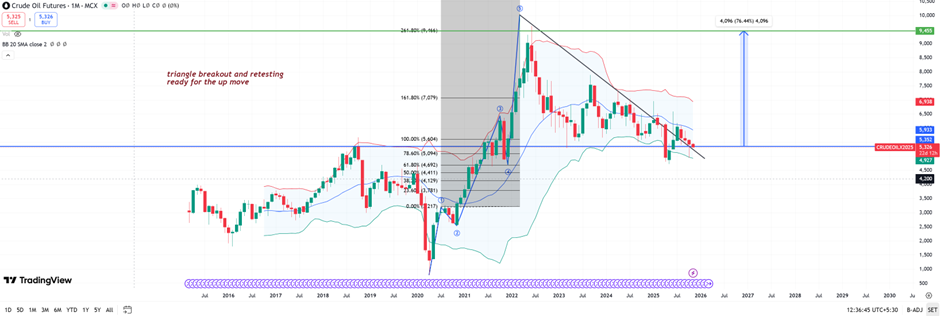

5.Crude oil shock:

India’s imports 85% of crude oil and its ready for upward move and it has a importers inflation loop and its effects the Gdp.

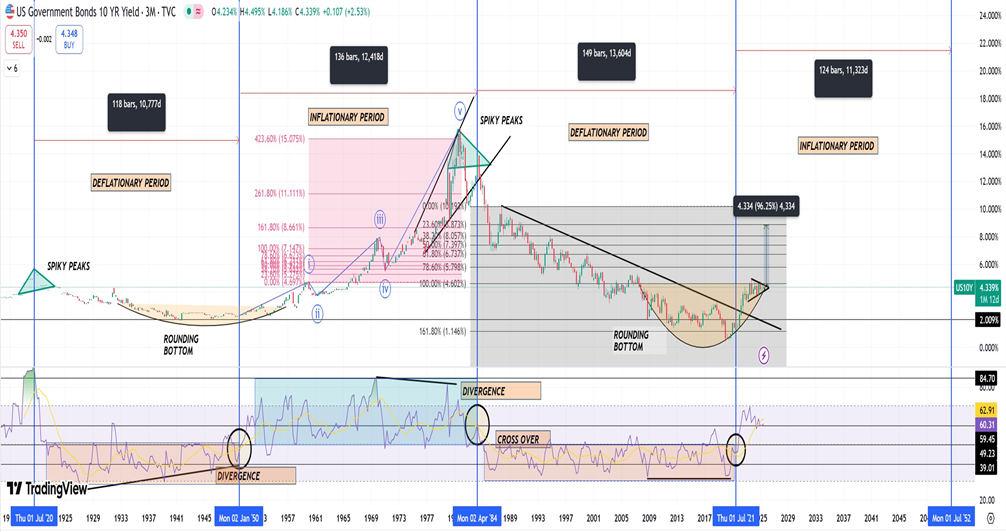

6.Low Global Yields Reversing:

Usa 10 – year government bond yields is the cost of the capital to the world, every currency and every country interest rates will move tandem with this yields. Which will attracts capital back to bonds from equities.

7.High valuations and earning slowdown:

Nifty current p/e ratio is 24.5x which is expensive with corporate earning growth at 8%. The average nifty p/e ratio is 19-20x for good buying average.

I expect nifty to correct form the present levels based on my chart formations along with fundamentals